It is said that any given farmer will have forty growing seasons in his or her lifetime, giving them just forty chances to improve on every harvest. However, if there is no financing available for agriculture inputs, investing in agricultural technologies, or post-harvesting equipment, then farmers do not get their forty chances.

Over the last six months, we have highlighted some of the challenges to unlocking the potential of sustainable intensification in Sub-Saharan Africa through improved smallholder irrigation development. Two of the most important themes to emerge in these discussions include the centrality of gender issues when designing irrigation schemes and critically assessing the potentials of different technologies.

This discussion was continued during Stockholm World Water Week, at a session on “Enabling Investment in Irrigation in Sub-Saharan Africa.” The session focused on the importance of smallholder irrigation as a vehicle for enhancing food security and agricultural production. Much has been made about the need for support for agricultural inputs, the development of irrigation technologies appropriate for smallholders, and the need for institutions to incentivize the expansion of irrigation systems on smallholder farms. Although these are all important pieces of the smallholder irrigation puzzle, they are irrelevant as long as farmers cannot afford to build irrigation systems in the first place.

To put it another way: if financing is not available under the right terms and conditions, it will be impossible for smallholders to take advantage of the many opportunities that arise from irrigation.

Are public-private partnerships the solution?

Ruth Meinzen-Dick presented recent research which looked at public private partnerships (PPPs) in irrigation. Ruth stressed that “PPPs are definitely not a panacea to public financing and we need to better define what we mean by PPPs. Often, it follows the adage ‘I cannot say it, but I know it when I see it’.”

Her research—supported by the UK’s Department for International Development (DfID) and Economic and Social Research Council (ESRC)—developed new criteria for assessing public-private partnerships. This included adding in the concepts of risks and benefits assumed: if a business does not take on any of the risks assumed in establishing the partnership, then it should be considered ‘outsourcing’ rather than a PPP.

Case studies carried out in Tanzania highlighted a number of obstacles faced by the private sector in financing irrigation. In addition to considering the development of irrigation infrastructure, private investors also need to assess a wide range of secondary issues: these include local land tenure practices, price volatility for irrigation equipment, and the variety of different tax laws for the various types of infrastructure and hardware.

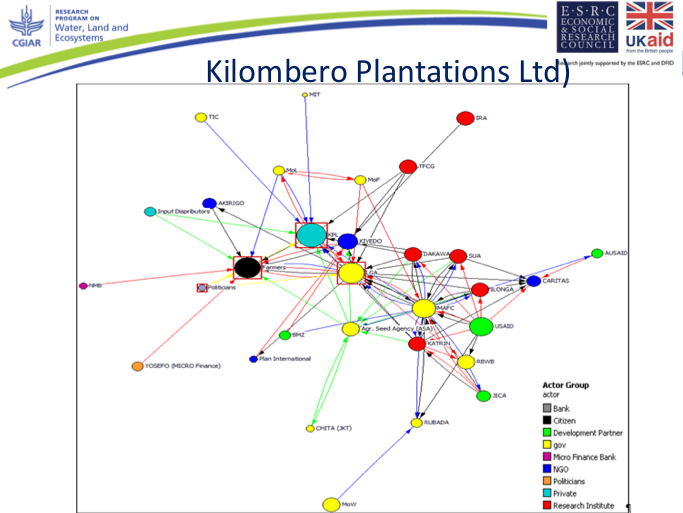

A Net-Mapping exercise (see figure below) found that a large number of diverse relationships exist between the private sector organizations, government agencies, and farmers groups involved in different steps within the agricultural food chain. Ruth concluded that “we need to accept complexity and continue to use tools for understanding complex arrangements. There is no silver bullet solution, and we need to embrace and engage [with] this complexity.”

Financing smallholders through credit: do we understand local contexts?

Apart from PPPs, participants also discussed the viability of credit as financing for smallholder irrigation. Three major challenges were identified: first is the high risk of agriculture and the high potential for crop failure. While crop insurance offers a potential means to mitigating this risk, it is still expensive and hard for most smallholders to access.

Timing presents another major issue. Since agriculture is dependent on having the right amount of money at the right time—for planting, post-harvest production, or accessing other inputs—conventional microfinance packages that require regular repayments do not work. The timing of loans and repayments need to be adjusted to the agricultural cycle.

Tim Prewitt from International Development Enterprises (iDE) made the case that we still don't understand farmers’ preferences and needs. There is a common belief that farmers are risk averse and not willing to take chances. However, anecdotal evidence from work that iDE has done on identifying farmer preferences highlighted that farmers are constantly assessing risk.

According to iDE’s research, farmers tend to consider the overall profits they can expect from growing and selling a specific crop. As stated by Prewitt, “Crops with high demand, high price, and large amounts are desirable. The price in market may not be high but the large amounts sold and the minimal investment costs and high market demand may offset the low price, translating into a good profit margin.” This goes to show that farmers themselves are skilled economic analysts in their own right.

Upfront investments are certainly necessary for enabling smallholder farmers to adopt irrigation for sustainable intensification. That said, learning about new commodities and emerging market opportunities is another crucial part of the equation. One such opportunity is the increased demand for fodder during dry seasons, which could serve as a supplement to more common dry season crops such as onions, tomatoes, and other vegetables. Increased demand for fodder means that farmers could potentially generate more income, but to do so, they will need sufficient access to water.

The session left off with many questions: what are the right mechanisms to finance smallholder production? What tradeoffs will farmers experience from using credit, compared to participating in PPP schemes, and how could those tradeoffs be mitigated? While much has been done to identify the appropriate technologies and institutions related to irrigation, the question of financing still needs to be addressed.

Although forty years may sound like plenty of time for farmers to turn a profit, every year without financial access is a wasted opportunity.

Comments

Farm loans have been mismanaged by both farmers and the governments. Many farm loans taken by farmers have been used for purposes (e.g., marriage, buying a vehicle or jewellery, etc.) other than agriculture, so repayment of loans has been a problem for many farmers. Other farmers have failed to repay loans for genuine reasons of crop failures that are beyond their control. Some governments have waived farm loans to all farmers for political reasons and it has destroyed the financing institutions that provided the loans. Farmers in some states have come to the level of considering farm loans as state handouts for political considerations. Politics destroys everything. There is no consistent policy in selecting farmers, granting, recovering, and management of farm loans for sustainable intensification of agriculture through irrigation. Thank you.